property purchase tax in france

It is payable by the individual who owns the property on the 1st. If you need assistance with your move we have a team of France property experts that can help at every crucial stage.

France Tax Income Taxes In France Tax Foundation

Depending on when you purchase a property in France and your personal circumstances.

. Contact us on 44 020 7898 0549 from. Compare that with the. The acquisition of a real estate property located in France triggers transfer tax which is due in principle by the purchaser.

Any person living abroad and owner of real estate in France is subject to French property tax. Here is how it is calculated. There are two different taxes for property owners in France.

Ad Do You Own Rental Property in France. This is payable at the end of each year in December and can also be paid monthly. Foreign nationals are permitted to buy residential and commercial property in France as individuals or through a legal entity.

If you are renting out a French property the net income will be taxed at the scale rates of income tax. The first one is the taxe FONCIERE or land tax the second one is the taxe dHABITATION council tax which is. There is no exemption.

There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in London and Nice France. In the overwhelming majority of departments the taxes amount to 580. There is some variation in the level of the taxes depending on the department in which the property is situated.

Ad 100000 properties in France. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. However it can be agreed by the parties that these.

We Can Help With Your French Tax Return. French property tax for dummies. 100000 properties in France - Houses Villas Apartments for sale.

There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and. French income tax. We Can Help With Your French Tax Return.

The French taxe foncière is an annual property ownership tax which is payable in October every year. Calculating Fees and Taxes for Buying Property in France. On average people in France spent approximately 851 euros to rent a house in 2021 and an average of 435 for a studio or one bedroom apartment.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. Its part of the larger Mesoamerican Barrier Reef. In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets.

In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of. Ad Do You Own Rental Property in France. If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45.

Because the notary will calculate and charge all the relevant taxes during the purchase process you will. Speak to an expert. Basis to tax.

The initial purchase of a property in France will incur various fees and taxes. The 172 French social charges cannot be offset against UK tax. Renting a real estate property in France generates rental income.

Houses Villas Apartments for sale on Green-Acres. The tax regime applied to rental income depends on whether the property is furnished or not.

Hidden Costs Of Buying Property In France Things You Need To Consider

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

French Taxes I Buy A Property In France What Taxes Should I Pay

French Taxes I Buy A Property In France What Taxes Should I Pay

Up And Running Fishing Business Large Lake With Two Apartments Surrounded By Woodland Dordogne Nouvell In 2022 Buying Property In France Dordogne Property France

France Tax Income Taxes In France Tax Foundation

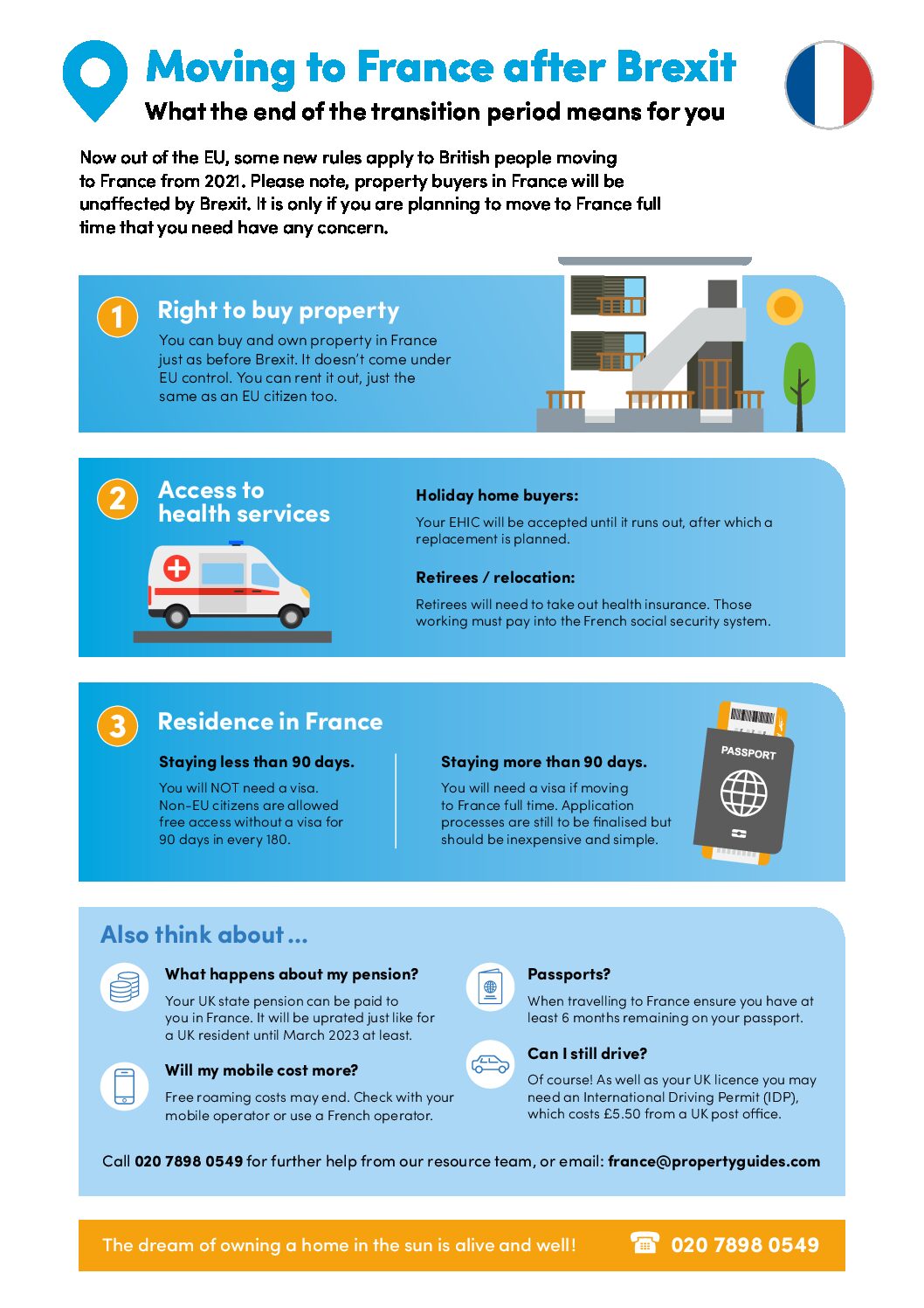

Buying Property In France After Brexit France Property Guides

France Tax Income Taxes In France Tax Foundation

Cjm For Real Estate Customer Journey Mapping Software Engineer Journey Mapping

Contract To Sell On Land Contract Contract Template Things To Sell Purchase Contract

French Leaseback Purchasing Property In France Lawyer In France Our Clients Require Daily Experience Of Bail Commercial Droit Immobilier Residence Etudiante

France Tax Income Taxes In France Tax Foundation

French Taxes I Buy A Property In France What Taxes Should I Pay

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Beginner S Guide To Owning French Property Frenchentree

French Taxes I Buy A Property In France What Taxes Should I Pay

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain